Exploring Pangolin

A Beginners Guide to an Avalanche (AVAX) AMM

Pangolin is a relatively new decentralized exchange (DEX) that was launched in February 2021 and has grown liquidity to +143M within the 6 months of operation. Within this article, we will explore:

What is an Automated Market Maker (AMM)?

Advantages and Disadvantages of a DEX

AMMs: A Savy Solution to the Disadvantages of a DEX

The Avalanche Difference

The Pangolin Approach

What is an AMM?

An automated market maker (AMM) is a type of decentralized exchange (DEX) protocol that relies on a mathematical formula to price assets; So instead of having a counterparty (another trader) on the other side to make a trade, you interact with a smart contract that “makes” the market for you. [Learn More: OrderBook_v.s._AMM]

Pangolin is an Automated Market Maker(AMM) platform that describes itself as a community-driven decentralized exchange for Avalanche (AVAX) and Ethereum (ETH) assets.

To understand the benefits of an AMM we must first examine the advantages and disadvantages of a DEX

Maintaining security, convenience, and privacy is one of the considerations that has led to the creation of DEXs.

DEX Advantages:

Security & Sovereignty: The biggest risk inherent to centralized exchanges are hacking and embezzlement or "exit scam". This is made possible because users place funds onto the exchange plat the operators of the centralized exchange have access to all the funds traded on the platform.

Canada: PONZI SCHEMES, PRIVATE YACHTS, AND A MISSING $250 MILLION IN CRYPTO: THE STRANGE TALE OF QUADRIGA

Turkey: Turkish crypto founder flees with reported $2.7 billion

South Africa: South African Brothers Vanish, and So Does $3.6 Billion in Bitcoin

On a DEX, however, users do not store his/her assets on any platform controlled by a centralized party. The assets remain within his/her personal wallet (maintaining sovereignty) with transacted funds being unlocked only when the user provides his/her private key.

Privacy: If users are concerned with Know Your Client (KYC) requirements, then using a DEX allows users to transact pseudo anonymously.

Disadvantages of DEXs

Transaction speed: DEX transaction speeds rely mainly on the blockchain on which the DEX operates. (see @cryptoseq tweet below)

Liquidity: As DEXs rely on active traders to provide liquidity, traditionally they usually suffer from limited liquidity. [Slippage Definition]

AMMs: A Savy Solution to the Disadvantages of a DEX

AMMs were made to overcome the disadvantages of the DEXs.

AMMs do not require the traditional interaction between buyers and sellers. Instead, AMMs utilize a liquidity pool by offering liquidity providers an incentive, usually in the form of yield similar to any bond or fixed income asset, to supply these pools with assets. So when a user wants to make a trade, he/she trades against a pool of tokens (the liquidity pool) instead of another user.

So how do you tell the difference between one AMM and the other?

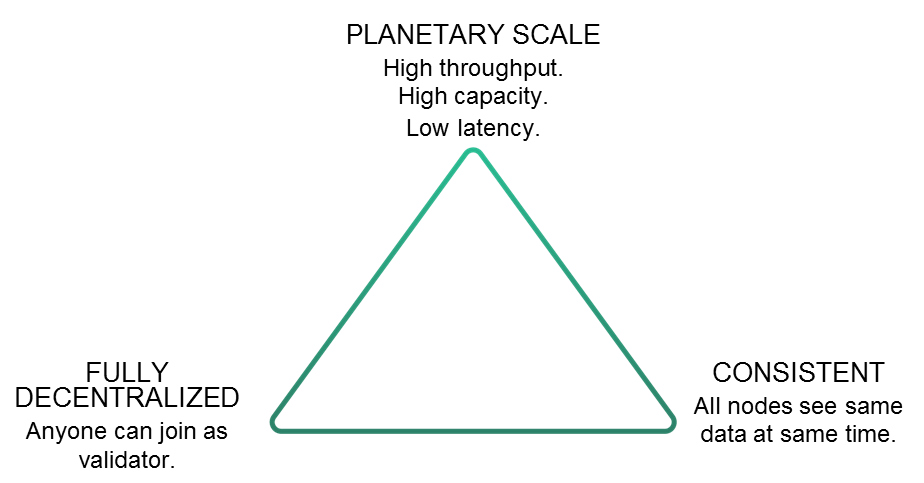

One of the biggest differentiators of any Defi token is the blockchain platform on which it operates. Every blockchain addresses the scalability trilemma, the trade-off between three fundamental properties of blockchain; decentralization, scalability, and consistency, differently.

[Advanced Read: Everything_You_Know_About_The_Scalability_Trilemma_is_Probably_Wrong]

[Novice Read: The_Scalability_Trilemma]

The Trilemma claims that blockchain systems can only at most have two of the following three properties:

1. Decentralization

2. Scalability

3. Security/Consistency

As most AMMs operate on the Ethereum blockchain, they differentiate themselves by utilizing different methodologies in the creation of their liquidity pools.

Uniswap’s pioneering technology allows users to create a liquidity pool with any pair of ERC-20 tokens with a 50/50 ratio, and has become the most enduring AMM model on Ethereum.

Curve specializes in creating liquidity pools of similar assets such as stablecoins, and as a result, offers some of the lowest rates and most efficient trades in the industry while solving the problem of limited liquidity.

Balancer stretches the limits of Uniswap by allowing users to create dynamic liquidity pools of up to eight different assets in any ratio, thus expanding AMMs’ flexibility.1

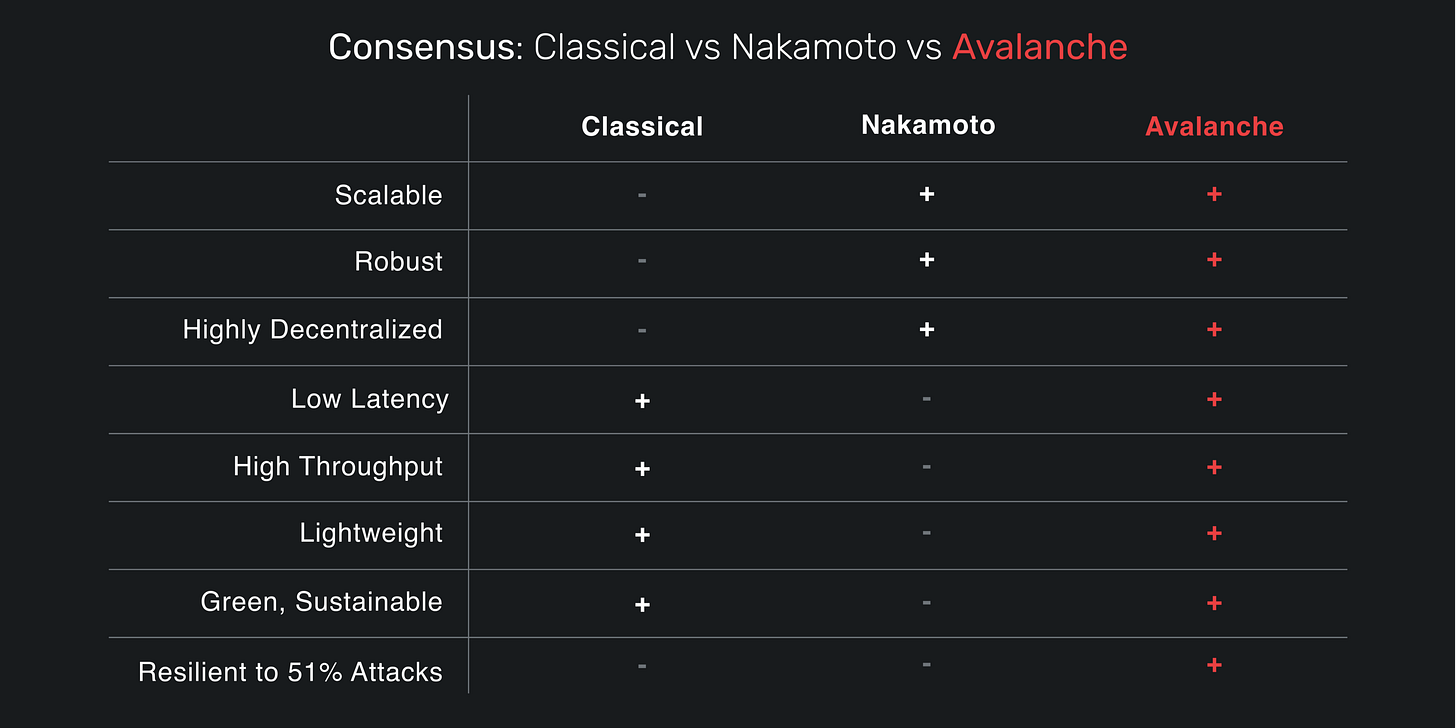

The Avalanche Difference

Protocols, such as Pangolin, that run atop Avalanche are very fast. They can achieve irreversible finality in sub 1 second, quicker than a typical credit card transaction. Avalanche can support ~17,000 transactions per second (TPS). For context Visa’s typical throughput of 4500 TPS.

[Learn More: Avalanche_ The_Biggest_Breakthrough_Since_Nakamoto]

For additional context on transaction finality:

Virtual Machine Ready:

Avalanche allows for anyone to launch subnets, supporting multiple custom virtual machines such as Ethereum Virtual Machine(EVM), WASM, Bitcoin VM, & Privacy VM.

Low Transaction Costs:

One of the best and most convincing reasons to utilizing an AMM on Avalanche is for the consistent and low transaction costs. This predictability can help bolster confidence in liquidity pool providers and users, driving a greater & more sustainable community involvement.

Let's Examine What Makes PNG different

PNG is a 100% community-driven governance token, it is distributed to the community.

Distribution

No PNG tokens are allocated to the team, investors, advisors, or any sort of insiders. Therefore, Pangolin is entirely community-driven and entirely community-owned. PNG is capped at a supply of 538 million tokens.2

5% of the tokens are given as airdrop to the recipients, that are people that used to hold UNI and SUSHI on December 7th, 2020

95% of the tokens are given to liquidity miners

To reinforce the project’s commitment to being created solely for the benefit of users, Pangolin is following a fair launch model with its governance token (PNG).3

Governance

A big part of the value proposition of PNG’s governance is that it is highly community-driven. Because there are no insiders, such as investors, team members, or other such stakeholders, the development of Pangolin remains entirely up to the wider community.4

On our Radar: Questions Edition

Fee Switch: The community will also have the ability to enable the Pangolin fee switch. This fee switch can divert .05% of all swap fees to a designated address. Swap fees will remain fixed at .30%, but liquidity providers will only receive at most .25% of these fees. This provides the community with the opportunity to acquire extra funds to support any significant community initiatives.

PNG now has a large amount of developer/ community support however with what will happen without any monetary support for developers? Will they ever turn on the fee switch? If the community does, will it be a non-event?

https://www.gemini.com/cryptopedia/amm-what-are-automated-market-makers#section-automated-market-maker-variations

https://pangolin.exchange/litepaper/

https://pangolin.exchange/litepaper/

https://pangolin.exchange/litepaper/